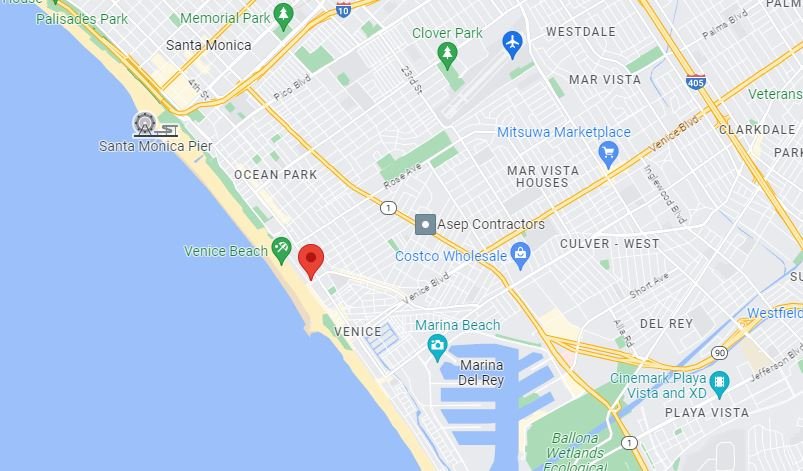

Record Multifamily Sale in Venice, CA

DEAL STORY

According to CoStar’s records of all-time sale statistics for multifamily properties in Venice, CA, which account for all sales in the past 40+ years, this sale is the #2 highest in terms of both Price/Unit and Price/SqFt. If we exclude non-rent controlled buildings, it becomes the #1 highest Price/Unit ever achieved in Venice for a rent-controlled property. Furthermore, we believe it is reasonable to consider this the best sale ever achieved in the city of Venice, as it is the only multifamily sale, regardless of year built, to exceed $1,000/SqFt AND $800,000/Unit.

This deal was put together off-market. Typically, we would not advise our clients to sell their property off-market, as a full marketing campaign is usually the best way to secure top-of-the-market pricing. However, this was a rare situation where we had the perfect buyer for the seller’s property, and it made sense for him to sell without listing it.

The buyer for this deal is the same buyer with whom we have already closed two deals in the recent past. They are actively seeking turn-key, renovated multifamily properties in “A” locations throughout Los Angeles. The buyer aims to invest in historically safe and appreciating markets and is less concerned about cash flow. They prefer fully renovated properties to avoid management responsibilities or value-add projects.

The LAAA Team approached the seller of this property in mid-August. The seller owns multiple properties in prime locations and consistently renovates them to the highest standards. We inquired if he would consider an offer for any buildings in his portfolio. He provided financial information on a few properties he was willing to sell. The buyer expressed interest in two of the properties and made offers on both. Today, we closed on both buildings (the other property purchased from this seller is in Santa Monica; we will send an email announcement soon).

The buyer presented a strong offer of $5.0M for this property, which the seller accepted without a counteroffer. The escrow proceeded smoothly according to the agreed-upon terms: the buyer removed all contingencies within 10 days, without requesting any price reduction or credits. Today, we closed escrow as scheduled, exactly 60 days after opening.

The buyer utilized Sharone Sabar from Marcus & Millichap Capital Corporation to secure financing and handle the loan process. Sharone successfully arranged a loan from a bank with a 60% loan-to-value (LTV) ratio and a 3.30% interest rate, which will be interest-only for the first 7 years.