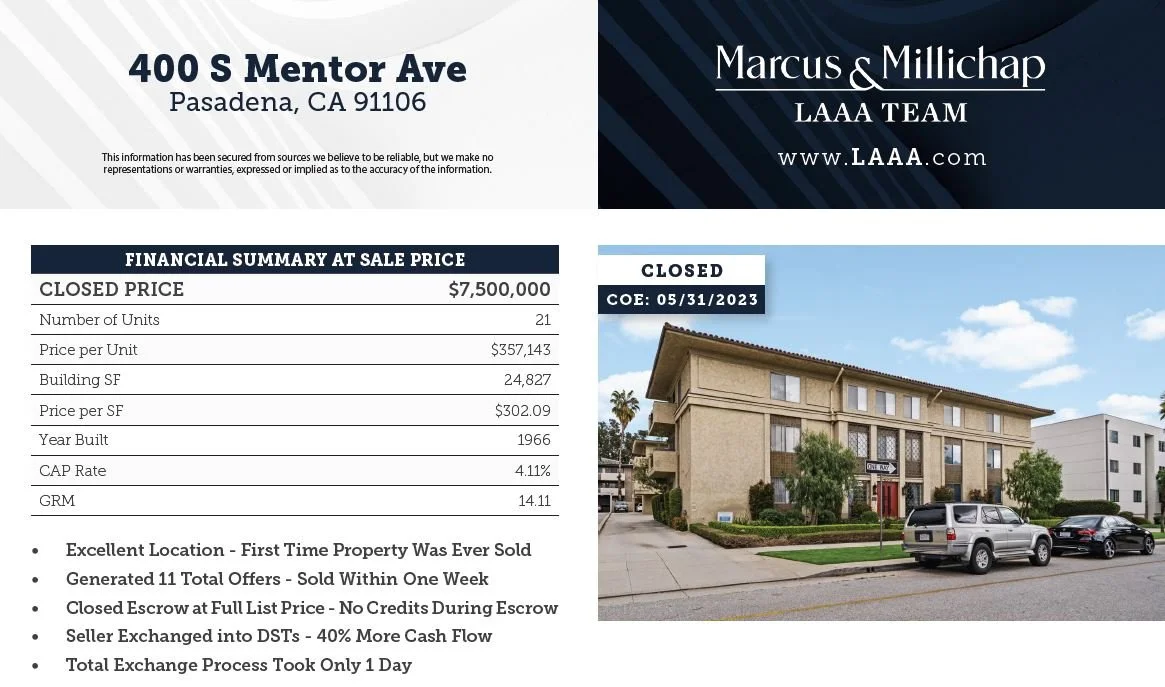

Impressive 21-Unit Sale in Prime Pasadena

DEAL STORY

This deal unfolded seamlessly. We listed the property in March 2023 and received an immediate full-price offer from a highly qualified buyer. The sellers accepted the offer, and within a week, we opened escrow. The buyer fulfilled all obligations on schedule without requesting any adjustments, and we successfully closed escrow on May 31st, just over 2 months after listing.

What makes this deal remarkable is not just the transaction itself but the journey to earn our clients’ trust. It started with a cold call from our agent in late 2018. Over the next four years, we engaged in multiple interactions, gaining their trust and eventually facilitating the exchange of their underperforming apartments. From the initial contact to closing escrow, it took a total of 4 years, 5 months, and 16 days.

This deal exemplifies our long-term thinking and client-centric approach. We prioritize our clients’ interests above all else, providing trusted advice rather than pursuing short-term gains. We advise clients to hold onto their assets when selling might not be the best option and remain dedicated advisors throughout their ownership. We assure our clients that we will be there to assist them whenever they decide to sell, now or in the future.

1031 Exchange Case Study - DSTs

To access the complete 1031 exchange case study, CLICK HERE.

We are excited to present this 1031 exchange case study, showcasing the growing popularity of Delaware Statutory Trusts (“DSTs”) among our 1031 exchange clients. When our clients hear DST, they often associate it with TIC, a pre-recession investment structure that caused significant financial losses for many. However, DSTs are distinct and safer compared to their predecessor.

- For a detailed read on DSTs vs. TICs, please CLICK HERE.

- Or, CLICK HERE for a quick summary of the differences

Highlighted DST benefits:

1. Increased net cash flow: Up 40% for sellers.

2. New depreciation schedule: Shield $116k annually from taxes.

3. Freedom from management: Hassle-free cash flow for buyers.

4. Elimination of Deferred Maintenance: Escaped $250,000 of Work

5. Rapid exchange process: Closed in just 1 day.

6. Diversification: 63 properties in 6 states, spreading risk.

Through this deal and case study, we showcase our commitment to our clients’ long-term success and provide them with valuable investment options like DSTs for their 1031 exchanges.