Record Sale for a 4-Unit in 90036

DEAL STORY

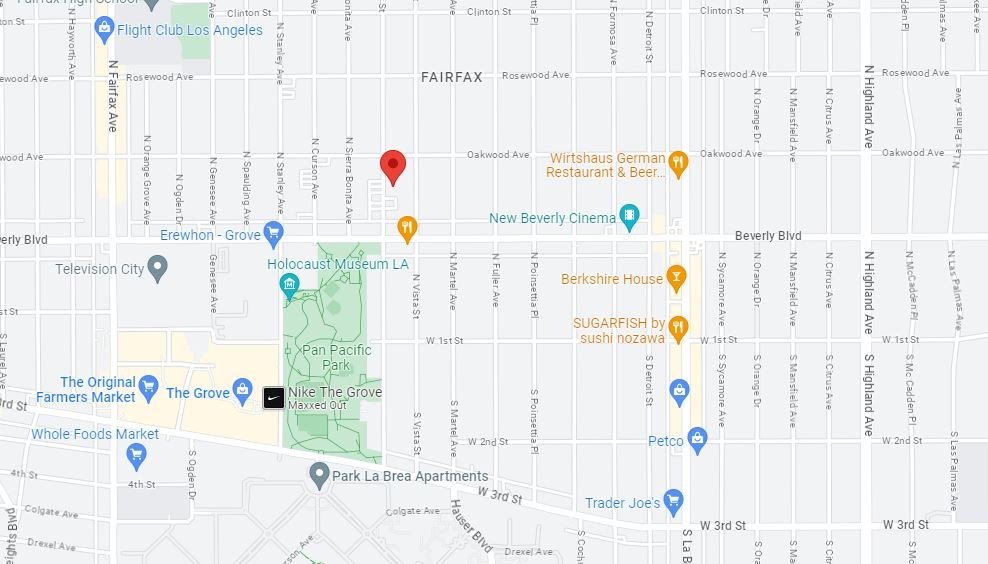

This sale ranks fourth for a 4-unit apartment building in the 90036-zip code. The three higher sales were fully renovated properties in a better market with lower interest rates. Remarkably, we now account for two of the top five sales on this list, with our previous listing at 854 S Sycamore closing in 2022.

In June 2022, the seller contacted us after witnessing our successful sale of a similar 4-unit building at 854 S Sycamore. After 44 years of ownership, the seller sought our opinion on the property’s value. Strategically, the seller left units vacant through natural turnover, without resorting to cash-for-keys agreements or renovations. Once three of the four rent-controlled units became vacant, the decision to sell was made.

At the time of the seller’s contact, the market was beginning to change, with the Federal Reserve implementing a third consecutive rate hike. The seller expected close to $3 million for the property, considering their knowledge of the market and the value of the three vacant units. However, recent comparable sales were no longer directly comparable due to the rapidly changing interest rate environment. After thorough analysis, we advised listing the property at $2,895,000, with an expected sales range between $2.7 million and $2.8 million. The seller agreed, and the listing agreement was signed in early September 2022.

Following the listing agreement, we reached out to the half-dozen offers received for our similar listing at 854 S Sycamore, which had closed just three weeks prior. Unfortunately, all six buyers were either no longer interested or offered significantly lower values due to the rapidly changing market. Fortunately, leveraging our extensive database, we generated two solid offers from new buyers within one week of marketing.

Both buyers’ offers were almost identical in price but varied in terms. The seller chose to counteroffer only one of the buyers based on their larger portfolio of apartments in the surrounding area and our prior successful escrow closure with them.

The buyer accepted the seller’s counteroffer of $2.8 million, with a shortened 7-day due diligence period and a 60-day close of escrow. Escrow was opened on September 16th, just nine days after commencing the listing’s marketing.

During due diligence, the buyer discovered more deferred maintenance than anticipated and had concerns about potential lead-based paint issues during their planned renovation. Negotiations resulted in a discount from the seller, including a $50,000 price reduction and an additional credit towards the buyer’s closing costs, facilitating the closing of escrow.

Although this deal presented more stress than desired, we recognize the challenges posed by a changing market. Nonetheless, we are pleased to achieve a record sale price and navigate a problematic escrow successfully. The seller is highly satisfied, using half of the sale proceeds for a 1031 exchange into an investment house while enjoying retirement with the remaining funds. The buyer is content with their purchase, seamlessly fitting into their portfolio of over 10 apartment buildings in the nearby area.